I thought I’d share my crude notes on a very interesting talk about energy storage from Tesla CTO JB Straubel. The slides are available as a PDF.

- JB Straubel Keynote

- CTO, Tesla

- Previously CTO & co-founder of Volcom, specializing in high-altitude electric aircraft platforms

- Board Member, Solar City

- Why is Tesla Deeply invovled in Energy Storage

- EV Battery History

- Status quo was led-acid in 1995

- Stagnant performance

- LiIon made possible Tesla and the rebirth of EVs

- 4x gravimetric energy density

- 6x volumentric energy density

- 2x cycle life

- Tesla was first to do Li-ion R&D for vehicles in 2003

- Status quo was led-acid in 1995

- Tesla Roadster 2008

- Sought to challenge internal combustion vehicles on more than just fuel economy

- ~2,500 sold

- Largest battery pack in a vehicle

- 50kWh +

- Optimism based on progress of LiIon cells

- ~2x improvement in energy storage capability of batteries in the decade between EV1 era and the Tesla Roadster

- 300Wh/litr to 600Wh/litre

- Accompanying weight reduction as well

- In talking to companies involved in 2005, they saw no reason for progress to plateau

- Ten years later, they expect progress to continue for the foreseeable future.

- 40% improvement between introduction of the Roadster and the Model S

- ~300 miles range

- 85kWh

- Smaller pack than the roadster

- See this trend continuing for the next 10-20 years

- Only 10-20% away from being able to compete broadly with the internal combustion engine.

- ~2x improvement in energy storage capability of batteries in the decade between EV1 era and the Tesla Roadster

- Long term goal is to sell millions of cars

- Energy storage is the biggest factor influencing cost, and therefore, volume.

- Current offerings

- Roadster

- Model S

- Main focus

- OEM

- Toyota RAV 4

- Mercedes-Benz

- BClass

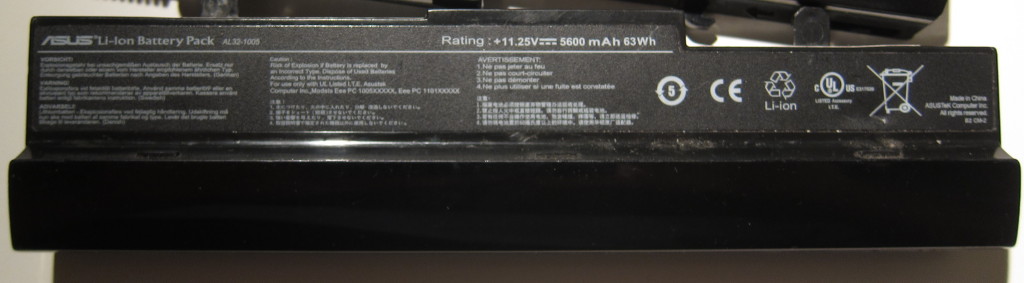

- Model S Battery Pack

- Scale & Scope have enabled a cost point that is competitive in other markets outside cars

- Utilities

- Energy density is a key path to lower cost

- Automobiles

- Not intuitive

- Some automobile manufacturers have tried to cut energy to cut costs.

- 200Wh/Kg

- Benefits for stationary storage

- smaller footprint

- easier retrofit

- Automobiles

- Current costs and projections are on track

- Manufacturing volume is important too.

- Goal to build 500,000 Gen3 vehicles/year

- using capacity in existing Bay Area Plant

- Energy storage required to meet that goal is another story

- In 2013 ~34 GWh of lithium ion batteries were manufactured, but from ~21 GWh in 2010.

- Tesla’s projects to use 3-4GWh in 2014

- Approximately 10% of WW volume

- 500,000 Gen3 vehicles/year will require 10x current, or ~35GWh of batteries in 2020.

- Gigafactory sized to meet that demand

- Would still only supply 0.5% of WW new car market.

- Doubling WW capacity

- Reengineering supply chain with major opportunity for cost cutting

- 30% cost reduction by 2017 ramp-up

- Thinks that the market for non-automotive storage will grow even faster than the electric car market.

- Grid storage is slow to mature, but once you cross certain price thresholds, it becomes a commodity market that sells on cost savings

- Approach to cost reductions at the gigafactory

- Looking at everything, including the sourcing of the raw materials.

- Materials are a meaningful portion of the cost of cells

- Plan to use their purchasing power to use demand as leverage for sustainable practices throughout the supply chain (labor practices, energy, etc)

- Gigafactory

- 35GWh of cells

- 50GWh of packs

- 15GWh for stationary packs

- 10x of the California mandate

- 15GWh for stationary packs

- Goal to build 500,000 Gen3 vehicles/year

- EV Battery History

- Tesla and Stationary Storage

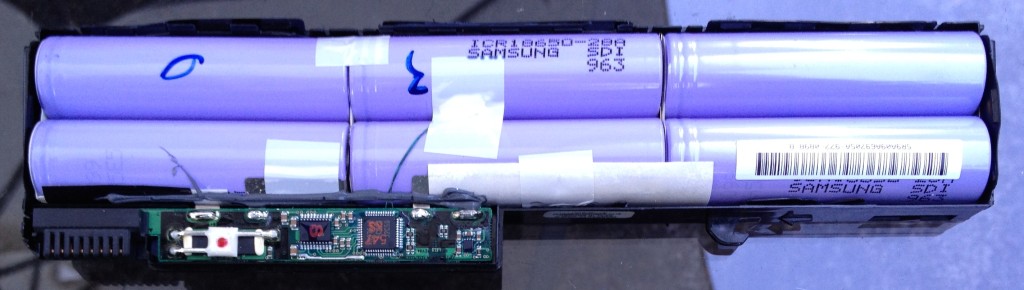

- ~2012 adapted vehicle pack architecture for residential energy storage packs

- 5kW/10kWh

- Originally targeted at people with solar and teslas

- Slow to scale

- ~1000 systems

- People who wanted to play with energy in their house

- Peak demand management

- “Islanding” to isolate their system from grid and allow operation in the event of a power outage

- Experiment with aggregation of systems

- Coordinated across households

- Business models are a challenge

- New experiment is a larger-scale system

- Module

- Based on model S pack architecture

- Different arrangement of modules

- Same cooling and management

- Two hour-rate pack.

- 200kW / 400 kWh+

- “Single skid” unit

- Roughly the size of a shipping pallet

- 800Kg

- Based on model S pack architecture

- Pilot deployment

- SuperCharger location

- Big enough to be worth the time

- Very peaky load

- Up to 250KWh peak demand from cars

- <100KW peak from meter

- SuperCharger location

- Thinks that utility side opportunities are significant

- Backup power

- Demand management

- Scale up of renewables

- This will be the major driver for storage!

- Major adjustments needed in rate structures/incentives

- es- I wonder where trends in peak generation costs vs storage costs cross

- Large Pilot (2013)

- “One of the bigger installations”

- Tesla’s Fremont plant

- 1MW / 5 modules

- Manages ~10% of peak demand

- 100 MW substation with 100kV tie.

- 1-2% of installed grid-attatched storage

- In the process of doubling capacity

- “One of the bigger installations”

- Module

- ~2012 adapted vehicle pack architecture for residential energy storage packs

- Thinks of Tesla is an energy innovation company, more than a car company.

- Cautionary note about building for economic sustainability, avoiding dependency on incentive programs

- Innovation needed in storage management technology and relationship to grid and generation

- “The stone age came to an end not for lack of stones, and the oil age will come to an end not for lack of oil”

- Thinks the economics of renewables are already compelling and now constrained by storage

- Q&A

- Can the world support the scale up from a primary resource point of view

- Li-ion are primarily graphite/carbon for anode, nickle for the cathode (for their chemistry). Steel for can, polymers for separators, organics for electrolytes

- Predictions of shortages of lithium aren’t well founded

- Thinks there is a bubble in lithium prices, but Li-ion costs aren’t the major contributor to lithium cell costs

- Have you thought about the policy changes needed to drive this change?

- They have been building relationships with CPUCs and utities and even state and fed regulators, but it isn’t a big focus.

- Tesla is an innovation company that focuses on creating products that drive the need for regulatory changes.

- Utilities are conservative. Automotive experience is demonstrating that this technology is ready for utility use.

- Recyclability of lithium ion batteries

- Recycling is being built into the Gigafactory. With enough volume there are great opportunities for materials reuse.

- Challenge now is that growth is so steep that the volume of cells coming back is so much lower than current production

- What is the commercial lifespan of Lithium Ion batteries?

- Lithium ion batteries for the next 5-10 years

- Not waiting for the next big thing…

- Lithium ion cells make business sense now, which is why they investing.

- Looking historically, improvements aren’t necessarily revolutionary.

- Often it is through incremental improvements to components of the system that can leverage a lot of existing infrastructure for building cells and packs

- Better cathodes

- Better electrolyte

- Better separators

- Thinks we can double energy densities with better anode and cathode materials over the next 10 years.

- Often it is through incremental improvements to components of the system that can leverage a lot of existing infrastructure for building cells and packs

- 18650 vs other formats

- Thinks people are hung up on form-factor for no good reason

- At the scale they are dealing in what matters is whats inside.

- What matters

- Cost of materials

- Thermal / Safety parameters

- Their conclusion is that relatively smaller form factor are a reasonable optimization tradeoff between safety, thermal and cost.

- Slightly larger than an 18650

- Cylindrical makes sense from a cost perspective

- Some applications will have different characteristics

- Large cells just move complexity inside the cell

- Deployment plan and pricing metrics for fixed storage

- Depends on market

- Residential

- Leased to customer, bundled with larger offering

- Mid-market commercial customers

- Many prefer to buy outright

- Others want Tesla to provide savings, take care of utility interconnect, etc

- Some people don’t want to arbitrage their energy

- He did it at his for a while. Got bored with it

- Thinks at the end of day, Tesla or a 3rd-party financing company will end up owning most of the packs and be responsible for management

- Utilities are another matter, given the scale and dollars involved.

- Residential

- Depends on market

- Have you developed a center to deal with dispatch of modules?

- They are building it.

- Failure rate and warranty for modules

- Quite reliable

- Automotive application is much harsher

- Maybe over-engineered for fixed application

- Warranty rates are great

- Degradation profile

- Similar to cars

- Optimized for 10 year life

- Avoid paying too much for a product that outlasts the product, or the pack.

- What are your perspectives on the power converter, are you building it yourself?

- System design and integration are their major focus, just as with automobiles.

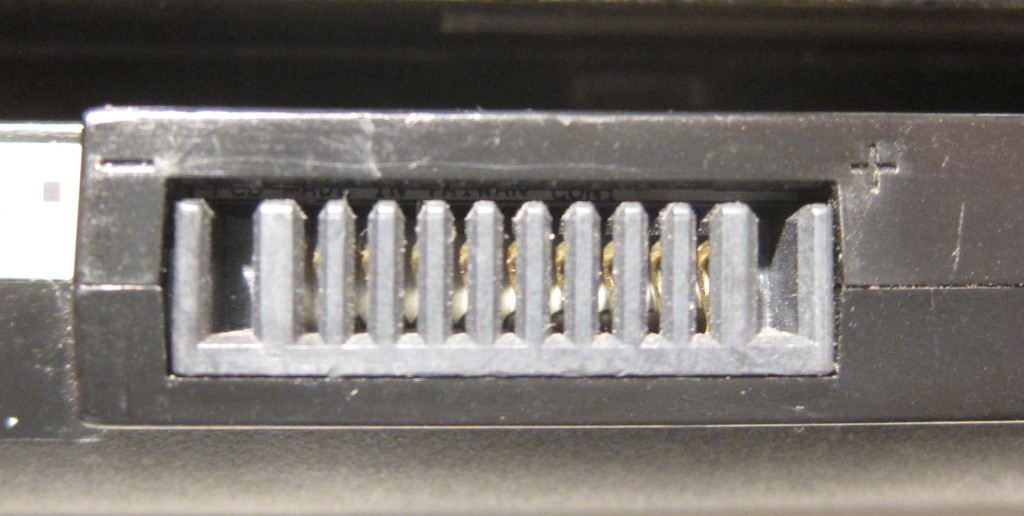

- The power electronics for Tesla Model S is a very capable starting point for these fixed storage modules.

- Costs for the power electronics are dropping quickly, will see less than $0.10W very quickly.

- Can the world support the scale up from a primary resource point of view