Today, I’m going to look at GBatteries, a startup incubated at YCombinator in 2014 that is now based in Ottawa. Their first consumer product, BatteryBox, was launched on Kickstarter last year, and as of January 2015, they were shipping. BatteryBox is a 60Wh (~14,000 mAh @ 3.7v) backup battery pack for Apple MacBooks and USB powered devices.

Last summer, I decided to dig into the subject of lithium ion battery reuse. Tomorrow’s used batteries are today’s new batteries, so I’ve been learning what I can about what today and tomorrow hold for new batteries. Its really too much for one person to go into in great depth, but I’m still trying to get a better lay of the land, and part of that effort is looking at battery-related startups like GBatteries.

If you visit the GBatteries site, the first thing you see isn’t the BatteryBox, instead you see a plug for “BatteryOS” their new battery management system that “increases battery capacity and cycle count.” It goes on to say:

BatteryOS is a new way of controlling rechargeable lithium-ion batteries that enables any normal battery to have higher capacity and not degrade over time.

It’s clear then that BatteryBox is an application of their new technology, a way to prove the value of BatteryOS value while bringing in some revenue, with he longer term goal of licensing technology and/or selling components that device makers will incorporate into their own products.

Digging in a little deeper, we find that GBatteries gets more specific about the claims about BatteryOS:

10-40% more capacity (varies between specific type of li-ion chemistry), have a 4x higher cycle count, and not degrade in capacity over time.

In considering these claims, it helps to understand a bit about industry standard approaches to lithium ion battery design and management. To start, lets define key factors:

- Energy capacity / density

- Power delivery

- Lifetime

- Safety

- Cost

These factors are all, to some degree, interdependent, which allows designers to trade them off aginst each other. For portable consumer electronics devices, like phones and laptops, the working range fall into a relatively narrow space.

Within that space, one tradeoff designers make is energy capacity vs cell lifetime. A simple choice offered to designers is to sacrifice ~10% of the overall energy capacity of a battery in exchange for a doubling of its lifetime. This is usually accomplished by limiting the maximum voltage allows when charging, and the minimum voltage when discharging.

With this background, we start to understand how BatteryOS might deliver on its promises:

- 10-40% more capacity (varies between specific type of li-ion chemistry)

- 4x higher cycle count

- not degrade in capacity over time

What they seem to be saying is that a device designer can have their cake and eat it to. Rather than giving up capacity for lifespan, or trading lifespan for capacity, they can have it all, and more.

Gbatteries claims that they have patents pending, but despite starting the company in 2012, and participating in YCombinator a year ago, I can’t find any relevant patents for father and son co-founders Tim and Nick Sherstyuk, so it is hard for me to evaluate their claims in more detail.

The BatteryBox would seem to be a chance to test these claims. They’ve been shipping them out to Kickstarter supporters for the past few months, but so far, I haven’t been able to find any independent tests and I’m not in a hurry to buy one and reverse engineer it.

We can, however, evaluate the published claims about BatteryBox BatteryOS, and other products and see if everything makes sense.

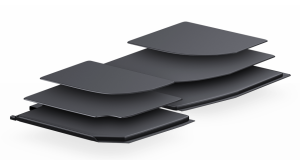

Salient details about BatteryBox:

- $219 price ($129 to kickstarter backers)

- 60Wh from 5 pouch cells

- 49x95x63mm

- 404g

Lets start with the price. There are a number of external battery packs available for laptops, but only a handful that work with the MagSafe connector on Mac laptops.

Hyperjuice sells a 360g, 60Wh battery pack that works with Macs for $199 that includes a DIY kit to adapt your existing MagSafe cable, for $249, you can get one with an already modified MagSafe adapter.

Voltaic Systems sells a 72Wh pack for $129, and a modified MagSafe cable for $20. It weighs 558g.

Both HyperJuice and Voltaic are bundling a MagSafe connector with rebranded external battery packs designed and manufactured by someone else, and similar packs are available from other brands as well, such as this $99 Anker-branded version of the same 72Wh pack Voltaic is selling.

Adapting MagSafe cables isn’t officially sanctioned by Apple, but clearly, HyperJuice and Voltaic have been willing to take the risk, and seem to have achieved some success over the years. For some reason though, Gbatteries decided to go another route with BatteryBox, developing a non-magnetic, MagSafe compatible connector that clips on to the side of the laptop.

I don’t know why Gbatteries decided to take this route. It may be the risk-intolerance of their funders, or perhaps they want to avoid antagonizing Apple because they hope to sign them up as a BatteryOS customer in the future. The advantages to consumers over a $20 MagSafe cable from Ebay aren’t apparent.

What is obvious is that for 55% the price of the BatteryBox, one can get a $20 cable and a $99 Anker pack with 20% more initial capacity. The Anker pack is also 20% heavier, but its thin form-factor makes it easier to tuck into a laptop bag than the BatteryBox.

From a cost, capacity and density point of view then, BatteryBox’s use of BatteryOS doesn’t provide obvious benefits over the status quo at time of purchase. Of course, that’s not everything it promises.

The other benefit BatteryOS is supposed to provide BatteryBox users is a 4x longer lifespan. Lithium ion batteries wear out due to a combination of time and use. That wear generally shows itself in a few different ways: increased internal resistance, decreased charge/discharge rates, and decreased capacity. In ordinary use, the decline is gradual and continuous, every charge discharge cycle results in a tiny bit of wear.

GBatteries is rather inconsistent in the way it talks about the battery lifetime benefits of BatteryOS. In one sentence, they claim both 4x the cycle count AND that the capacity won’t degrade over time. And yet, they also show a graph of runtime vs use that shows that the capacity of cells in BatteryBox decline noticeably over time, though at a lower rate than cells managed by traditional means. Its also worth noting that the graphs they show don’t start the Y axis at 0, which exaggerates the differences between the alternative management techniques.

In the long run though, it seems that the 20% capacity advantage and the almost 2x cost advantage of the non-battery-box solution goes a long way to offsetting the purported advantages BatteryOS brings to the BatteryBox.

Looking closely BatteryBox does help clarify some of the claims about BatteryOS. GBatteries claims significant capacity AND cycle-life benefits from BatteryOS. BatteryBox makes claims about significant cycle-life benefits, but the capacity tracks closely with that of other devices with the same weight, suggesting that the claims for BatteryOS don’t make the remaining tradeoffs clear.

While BatteryOS isn’t enough to make BatteryBox a compelling product, and while it may not provide all the benefits claimed, at least not at the same time, it might still be an important improvement to battery management, and provide a compelling benefit when incorporated into new versions of existing products.

Even so, I think GBatteries and BatteryOS face an uphill battle, because it isn’t clear to me that they bring anything new or unique to the table.

The lithium ion battery market was long dominated by the needs of consumer electronics devices like laptops, cameras, and mobile phones. The overall pace of progress in these product areas has been rapid, which drives relatively short upgrade cycles (2-5 years). When lithium ion batteries became durable enough to go mainstream, device manufacturers expected them to be replaced once or twice over the lifetime of the product. Since then, capacity improvements have been given at least equal weight with durability advances. Durability has improved enough that they are now expected to last the lifetime of the product they power, shifting even more emphasis to capacity improvements.

In this era, anyone needing greater durability often found it made more sense to work with cells from the consumer electronics market trading a bit of their superior capacity and cost for better durability.

This is exactly what Tesla did when designing the Tesla Roadster, which used 18650 batteries designed for laptops. Along the way, they developed their own techniques for better extending battery lifespan. In addition to the well-worn technique of limiting charging and discharge voltages to trade some capacity for durability, they also use a new charging profile. The traditional charging profile for LiIon batteries is to use a constant current (often the current required to fill the battery in 2 hours) to charge the cell to the voltage limit (typically 4.2-4.35v, depending on cell chemistry), and then hold the voltage constant until the current has drops to some predetermined threshold (often 1/10th the initial charge rate).

Tesla’s approach is to add another charging stage at the beginning of charge. This charging phase uses constant power, up to a voltage level below the final charging voltage target. This results in a decline in charging current as cell voltage climbs. This helps reduce heat generation at higher cell voltages, avoiding the combination of conditions that lead to the fastest cell wear. Once a threshold voltage is reached, charging switches to constant current to the final cell voltage which is then held until the current declines to its cutoff threshold. I expect that other companies have developed their own novel battery management schemes.

Of course, it doesn’t mean that GBatteries doesn’t bring something more to the table, but its also worth keeping in mind that some of the advantages they bring might be either offset or reduced by improvements in other areas. The most obvious is improvements in that batteries themselves. As I explained above, Tesla started by using cells from the consumer electronics industry for the Roadster.

For the Model S, they worked with Panasonic, their battery supplier, to design a cell for automotive use. It should be obvious that automobiles have longer lifetimes than consumer electronics by a, and that electric cars need to prove that their batteries will meet expectations set by existing automobiles. One obvious improvement for vehicle batteries then, is durability. In addition, cost and capacity will remain important considerations. The result I think, is that applications that need more durability than available from consumer electronics cells will now have the option of working with cells developed for the automotive market.

In the end though, the market for Lithium Ion batteries is so large already, and will quickly grow even larger, that an innovation that can offer a 10% improvement to 10% of the market could be very valuable. Whether or not BatteryBox was a good first step is in doubt. It targets a small portion of the overall market. It isn’t a compelling product in its own right, which makes it less compelling in demonstrating the value of BatteryOS. On the other hand, the experience they gained in developing and selling BatteryBox will probably help them better understand the issues that device makers, the potential customers for BatteryOS, deal with.